sales tax oklahoma tulsa ok

There are a total of 470 local tax jurisdictions across the state collecting an average local tax of 4242. The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales tax and a 365 city sales tax.

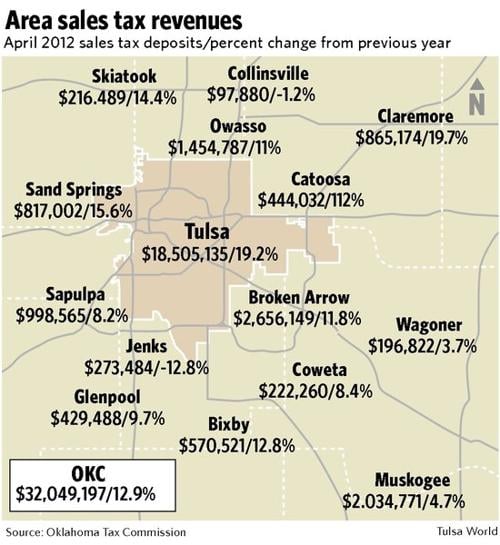

City Sales Tax Revenue Up 19 Percent For Month Politics Tulsaworld Com

Average Sales Tax With Local.

. An example of an item that exempt from Oklahoma is prescription medication. Sales or use tax on tangible personal property they bring in from out of state to use or consume. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877.

This is the total of state county and city sales tax rates. The December 2020 total local sales tax rate was also 4867. CONSUMER When the seller charges use tax on products when they are purchased by the consumer.

The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. Ponca City OK Sales Tax Rate. 7288 TULSA CTY 0367 7388 WAGONER CTY 130 7488 6610 WASHINGTON CTY 0409 1 7588 WASHITA CTY 2 7688 WOODS CTY 050 7788 WOODWARD CTY 090 Rates and Codes for Sales Use and Lodging Tax 4705 Cleo Springs 3 Use New January 1 2022 5507 Edmond 375 to 4 Sales and Use Increase January 1 2022.

Some cities and local governments in Tulsa County collect additional local sales taxes which can be as high as 5766. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11. Owasso OK Sales Tax Rate.

Shawnee OK Sales Tax Rate. Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

3 beds 15 baths 1400 sq. State of Oklahoma - 45. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax. The Tulsa County Oklahoma sales tax is 487 consisting of 450 Oklahoma state sales tax and 037 Tulsa County local sales taxesThe local sales tax consists of a 037 county sales tax. Sales Tax in Tulsa.

The Tulsa County Sales Tax is 0367. Stillwater OK Sales Tax Rate. Sales tax at 365 2 to general fund.

Oklahoma City OK Sales Tax Rate. The Oklahoma state sales tax rate is currently. The Tulsa sales tax rate is.

The Tulsa Sales Tax is collected by the merchant on all qualifying sales made within Tulsa. The Oklahoma sales tax rate is currently. It is charged when items are bought.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Sand Springs OK Sales Tax Rate. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. The 2018 United States Supreme Court decision in South Dakota v.

Some local sales taxes are for general purposes and some are dedicated or earmarked for specific purposes such as public safety major capital investments or jails. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Oklahoma tax commission 0188 adair cty 175 0288 alfalfa cty 2.

City salesuse tax copo city rate city salesuse tax copo city rate county salesuse tax. Tulsa County OK Sales Tax Rate. The Tulsa County sales tax rate is.

There is no applicable special. The City has five major tax categories and collectively they provide 52 of the projected revenue. The use tax essentially serves as a sales tax on imports to Oklahoma.

Use tax can also be noted and paid on the Oklahoma 511 income tax form. Tulsa OK Sales Tax Rate. In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

Sold at time of listing. The Oklahoma OK state sales tax rate is currently 45. To review the rules in Oklahoma visit our state-by-state guide.

7853 E Jasper St Tulsa OK 74115-6919 is a. Tulsa County - 0367. While Oklahoma law allows municipalities to collect a local option sales tax of up to 2 Tulsa does not currently collect a local sales tax.

The current total local sales tax rate in Tulsa County OK is 4867. VENDOR You can pay use tax at oktaptaxokgov. This means that an individual in the state of Oklahoma who sells school supplies and books would be required to charge sales tax but an individual who owns a store.

A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. The County sales tax rate is. The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax.

Has impacted many state nexus laws and sales tax collection requirements. House located at 15458 E Oklahoma St Tulsa OK 74116 sold for 160000 on May 17 2022. The Tulsa County Sales Tax is collected by the.

7288 tulsa cty 0367 7388 wagoner cty 130 7488 washington cty 1 7588 washita cty 2. This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. This is the total of state and county sales tax rates.

The Tulsa Sales Tax is collected by the merchant on. Sapulpa OK Sales Tax Rate. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

31 rows Norman OK Sales Tax Rate. Sales Tax Rate s c l sr. Sales in the two largest cities Oklahoma City and Tulsa are taxed at total rates between 8 and 9 percent.

For vehicles that are being rented or leased see see taxation of leases and rentals.

Sales Tax Exemption Letter For Oklahoma State Gov T Entities

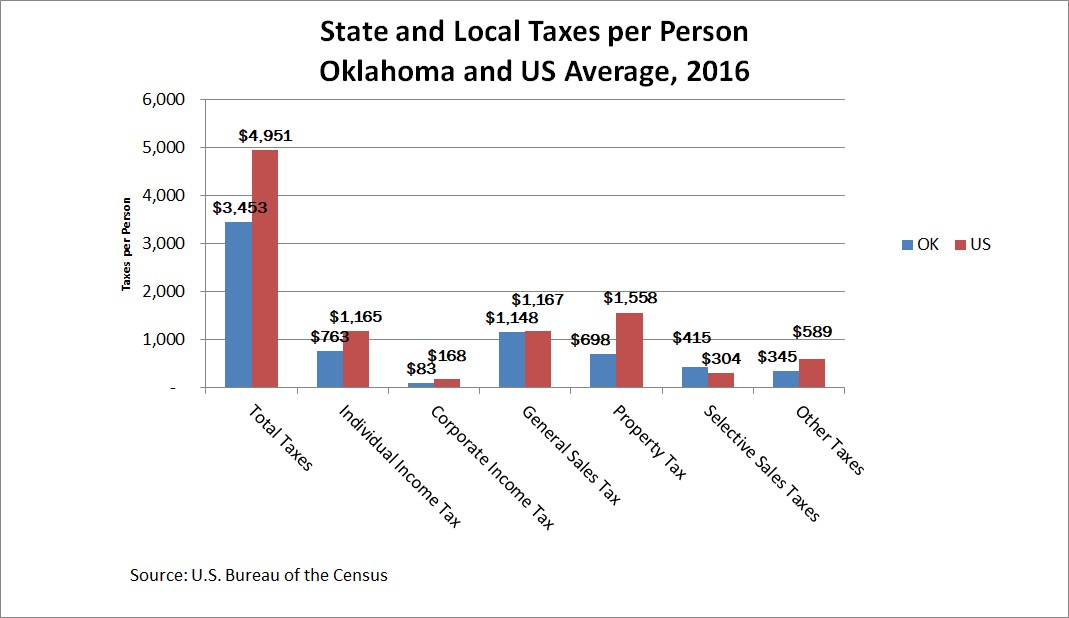

How Oklahoma Taxes Compare Oklahoma Policy Institute

The Fiscally Responsible Way To Reduce Taxes On Groceries Oklahoma Policy Institute

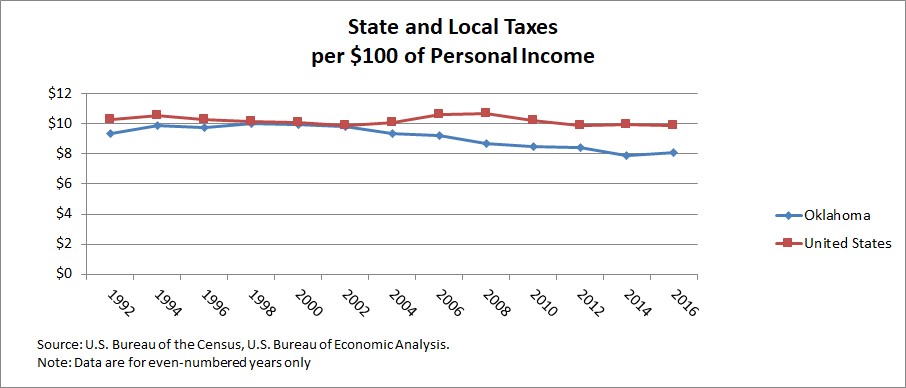

Oklahoma Tax History Oklahoma Policy Institute

Oklahoma S Tax Mix Oklahoma Policy Institute

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Ok Sales Tax Rebate Tulsa City Fill Out Tax Template Online Us Legal Forms

Taxes Broken Arrow Ok Economic Development

Total Sales Tax Per Dollar By City Oklahoma Watch

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Oklahoma Sales Tax Small Business Guide Truic

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Oklahoma Lawmakers Discuss Eliminating State Sales Tax On Groceries